Kentucky VA Mortgage Question and Answers for Qualifying for A VA Home Loan in KY?

|

I specialize in Kentucky First Time Homebuyers FHA, VA, USDA & Rural Housing, KHC and Fannie Mae mortgage loans. I have helped over 900 Kentucky families buy their first home and refinance their current mortgage for a lower rate; Kentucky First time buyers $0 down still available with down payment assistance with KHC. Free Mortgage applications same day approvals. Web site is not endorsed by the FHA, VA, USDA govt agency. Text/call 502-905-3708 kentuckyloan@gmail.com NMLS 57916 NMLS ID 1364

Kentucky VA Mortgage Question and Answers for Qualifying for A VA Home Loan in KY?

|

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Most Kentucky VA loans come with the added benefits of zero down payments, lower interest rates and no requirements for mortgage insurance.

The VA sets these Kentucky mortgage conditions and guarantees a portion of the loan amount which is in lieu of a down payment from the Veteran. Financing for the property purchase is still provided by a lender in Kentucky that does VA loans

Kentucky VA Borrowers will still need to be approved by a qualified lender under Kentucky VA loan conditions in order to secure this type of mortgage.

Kentucky specific requirements for A VA Mortgage loans.

While these loans generally follow the same processing steps nationwide, the VA does set specific requirements for some areas. Standards around energy efficiency, insect inspections and environmental hazards can all vary from state to state and borrowers are obligated to meet these standards for an approved loan.

What do I need to apply for a Kentucky VA Loan?

The Veteran or Active Duty soldier must get a Certificate of Eligibility to prove they can participate in the VA home loan program . This does not guarantee loan approval, but does allow the borrower to participate in the VA home loan program in Kentucky. See link below on how to obtain your COE from VA

https://www.va.gov/housing-assistance/home-loans/how-to-request-coe/

How is the interest determined on a Kentucky VA Mortgage Loan:

Mortgage rates change daily so whenever you go to apply for your VA loan, you can lock in your rate for a certain time period. This time period usually starts at 15 days and goes up to 90 day or some up to 180 days, but keep in mind, the longer you take out your loan lock, the higher the rate and costs of the VA loan.

Your credit score, loan amount, property state and lender you choose will set the mortgage rate for you. It pays to shop around for the best rate.

Mortgage terms are usually set on 30 year and 15 year terms. The shorter the term, the lower the rate on your loan.

Is there mortgage insurance on Kentucky VA Mortgage Loans:

They're no monthly mortgage insurance premiums for VA Mortgage loans. However, there is upfront mortgage insurance, in the form of an upfront funding fee that gets added on top of the base loan. See below Funding Fee Schedule

Review the VA funding fee rate charts on this page to determine the amount you’ll have to pay. Down payment and VA funding fee amounts are expressed as a percentage of total loan amount.

For example: Let’s say you’re using a VA-backed loan for the first time, and you’re buying a $200,000 home and paying a down payment of $10,000 (5% of the $200,000 loan). You’ll pay a VA funding fee of $2,850, or 1.5% of the $190,000 loan amount. The funding fee applies only to the loan amount, not the purchase price of the home.

| If your down payment is… | Your VA funding fee will be… | |

|---|---|---|

| First use | Less than 5% | 2.15% |

| 5% or more | 1.5% | |

| 10% or more | 1.25% | |

| After first use | Less than 5% | 3.3% |

| 5% or more | 1.5% | |

| 10% or more | 1.25% |

Note: If you used a VA-backed or VA direct home loan to purchase only a manufactured home in the past, you’ll still pay the first-time funding fee.

| First use | After first use |

|---|---|

| 2.15% | 3.3% |

Note: The VA funding fee rates for refinancing loans don’t change based on your down payment amount. If you used a VA-backed or VA direct home loan to purchase only a manufactured home in the past, you’ll still pay the first-time funding fee.

| Type of use | VA funding fee |

|---|---|

| Purchase | 1.25% |

| Refinance | 0.5% |

Note: The VA funding fee rate for this loan doesn’t change based on your down payment amount or whether you’ve used the VA home loan program in the past.

| Loan type | VA funding fee |

|---|---|

| Interest Rate Reduction Refinancing Loans (IRRRLs) | 0.5% |

| Manufactured home loans (not permanently affixed) | 1% |

| Loan assumptions | 0.5% |

| Vendee loan, for purchasing VA-acquired property | 2.25% |

Note: The VA funding fee rates for these loans don’t change based on your down payment amount or whether you’ve used the VA home loan program in the past.

Can I avoid a Kentucky Mortgage VA funding fee?

Yes. However, in order to avoid paying a Kentucky VA funding fee, your service history will have to match up with one of these requirements:

You already receive VA disability income.

You're eligible for disability income but receive active-duty or retirement pay.

You have a memorandum that states you're eligible for disability pay, dated before your loan closing.

You're an active duty Purple Heart recipient.

You're the surviving spouse of a veteran who died as a result of their military service.

Who pays for Closing Costs on a Kentucky Mortgage Loan:

The seller must pay these closing costs (sometimes called seller’s concessions):

You (the buyer) or the seller can negotiate who will pay other closing costs such as these:

Note: We require that a seller can’t pay more than 4% of the total home loan in seller’s concessions. But this rule covers only some closing costs, including the VA funding fee. The rule doesn’t cover loan discount points.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

The VA makes a guarantee to the lending institution (the

insurance)-for 25% of the loan amount (from a lenders

perspective the effective LTV is 75%).

Because the risk to the bank is reduced, the bank can provide

more affordable loans to the Veteran:

• Eliminating the need for a down payment (100% Mortgage)

• Provides the Veterans favorable interest rates

• Eliminating Mortgage Insurance (NO PMI)

• VA Mortgage Benefits do not expire.

• You can use your VA benefits as many times as you wish.

• You can have more than 1 at a time. (See occupancy rules)

• There is no limit to the size of a VA loan. (There is a county

loan limit, but veterans can purchase above the county loan

limit with a 25% down payment)

• Credit and risk is reviewed differently by each bank

and lender.

• Even with a foreclosure or short sale, the veteran may still be

able to buy a house with a VA loan. (See burnt entitlement,

veteran might have reduced buying power, but can still

use the VA loan). The VA understands that bad things can

happen to good people.

• VA Appraisals are significantly different than they use to be.

I don’t know if I still have my documents from when I

There are three websites that should be able to help you, they are:

archives.gov/veterans/military-service-records/

*If you have difficulty retrieving information from any of these sites,

the local recruiting office for your branch would be able to assist.

I have my discharge paperwork, but would like help

obtaining my Certificate of Eligibility

Contact your lender.

No, VA Home Loan benefits never expire. You can use your

VA benefit as long as you’re alive.

The VA Mortgage can be used several times over. If the previous

home was sold, your entitlement should be fully reinstated.

The VA does not have a minimum credit score, but lenders will

have their own internal overlay. If your score is greater than 580,

you are likely a candidate for the VA mortgage.

You can, with the same terms as buying a detached single family

residence. However, we do have to see if the condo association

is VA approved. Check this website:

vip.vba.va.gov/portal/VBAH/VBAHome/condopudsearch

I relocated here and have a home in my hometown. I

kept the home and it has a VA mortgage on it now.

You can get another VA Mortgage. Mortgage

will calculate your remaining entitlement to compute your

maximum loan amount with no money down and/or what

you would have to put down if you exceed the remaining

entitlement.

Yes, but there are several clauses that may make this difficult

to accomplish. Many veterans use their VA Home Loan

Certificate of Eligibility to negotiate in good faith a private home

construction loan and then refinance the completed home using

VA Home Loans.

There is a mandatory funding fee on all VA mortgages (unless

the borrowing veteran is receiving a VA related disability, then

the funding fee is waived). The funding fee is built over and

above the loan amount and the fees are as below.

|

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

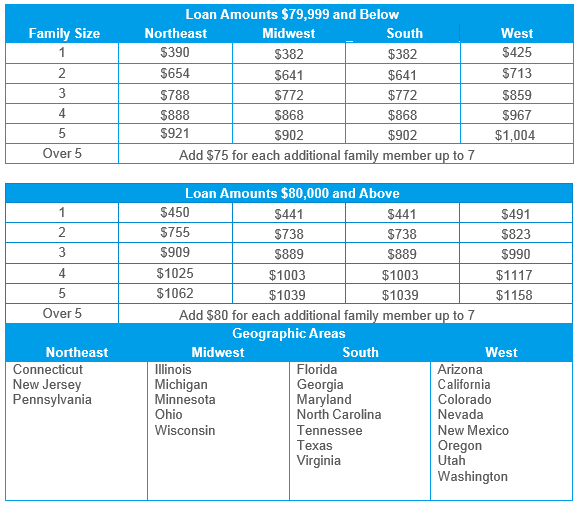

| Residual Income for a Kentucky VA Loan Approval |

Residual income is the amount of income remaining after housing expenses, income taxes, long-term obligations and other expenses have been deducted from the borrower’s total gross pay. VA requires a specific amount of monthly residual income be available for the borrower’s use. This amount is based on the family size, location of the property and loan amount.

|

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.