: Basic Understanding of a Kentucky VA Mortgage Loan Approval Process. The VA makes a guarantee to the lending institution (the insurance)-for...

Basic Understanding of a Kentucky VA Mortgage Loan Approval Process.

The VA makes a guarantee to the lending institution (the

insurance)-for 25% of the loan amount (from a lenders

perspective the effective LTV is 75%).

Because the risk to the bank is reduced, the bank can provide

more affordable loans to the Veteran:

• Eliminating the need for a down payment (100% Mortgage)

• Provides the Veterans favorable interest rates

• Eliminating Mortgage Insurance (NO PMI)

Crushing the Myths of the VA Loan

• VA Mortgage Benefits do not expire.

• You can use your VA benefits as many times as you wish.

• You can have more than 1 at a time. (See occupancy rules)

• There is no limit to the size of a VA loan. (There is a county

loan limit, but veterans can purchase above the county loan

limit with a 25% down payment)

• Credit and risk is reviewed differently by each bank

and lender.

• Even with a foreclosure or short sale, the veteran may still be

able to buy a house with a VA loan. (See burnt entitlement,

veteran might have reduced buying power, but can still

use the VA loan). The VA understands that bad things can

happen to good people.

• VA Appraisals are significantly different than they use to be.

What military documents would I need

to have in order to get a VA mortgage?

I don’t know if I still have my documents from when I

served. How can I retrieve them?

There are three websites that should be able to help you, they are:

vetrecs.archives.gov

archives.gov/veterans/military-service-records/

ebenefits.va.gov

*If you have difficulty retrieving information from any of these sites,

the local recruiting office for your branch would be able to assist.

I have my discharge paperwork, but would like help

obtaining my Certificate of Eligibility

Contact your lender.

I served, but it was a very long time ago. Do my VA

benefits for a mortgage expire?

No, VA Home Loan benefits never expire. You can use your

VA benefit as long as you’re alive.

I used my VA mortgage along time ago to buy a

home. That means I can’t use it again, right?

The VA Mortgage can be used several times over. If the previous

home was sold, your entitlement should be fully reinstated.

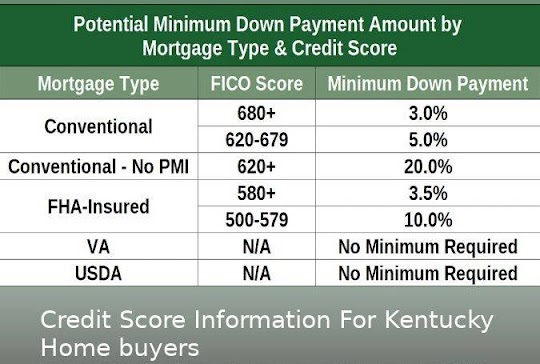

What is the minimum credit score to obtain

a VA mortgage?

The VA does not have a minimum credit score, but lenders will

have their own internal overlay. If your score is greater than 580,

you are likely a candidate for the VA mortgage.

Can I use the VA loan to buy a condo?

You can, with the same terms as buying a detached single family

residence. However, we do have to see if the condo association

is VA approved. Check this website:

vip.vba.va.gov/portal/VBAH/VBAHome/condopudsearch

I relocated here and have a home in my hometown. I

kept the home and it has a VA mortgage on it now.

Can I get another VA mortgage?

You can get another VA Mortgage. Mortgage

will calculate your remaining entitlement to compute your

maximum loan amount with no money down and/or what

you would have to put down if you exceed the remaining

entitlement.

Can I build a home with a VA Home Loan?

Yes, but there are several clauses that may make this difficult

to accomplish. Many veterans use their VA Home Loan

Certificate of Eligibility to negotiate in good faith a private home

construction loan and then refinance the completed home using

VA Home Loans.

I heard the VA Mortgage was more expensive than

other mortgage types. Is that true?

There is a mandatory funding fee on all VA mortgages (unless

the borrowing veteran is receiving a VA related disability, then

the funding fee is waived). The funding fee is built over and

above the loan amount and the fees are as below.

| It's Military May, and that means Permanent Change of Station (PCS) season for military families is upon us. However, some brokers will miss out on opportunities to help more Veterans due to a few commonly held misconceptions regarding Kentucky VA loans. Separating fact from fiction can make all the difference this season for your business. Here are a few myths around Kentucky VA loans: Myth: Kentucky VA Loans Are Credit Risks Reality: Kentucky Veterans and military members tend to have higher credit scores and savings. Myth: The Seller Pays the Closing Costs Reality: In a well-structured Kentucky VA loan, the benefits include no down payment and ideally no closing costs to the seller. Myth: There Is a Maximum VA Loan Amount Reality: There has never been a maximum Kentucky VA loan amount, though it's often confused with maximum VA loan guarantee. Myth: VA Loans Are Complicated With Many Restrictions Reality: The expertise of our Kentucky VA lending team makes the process simple so you can focus on your borrower.

|

|

|

|