Louisville Kentucky FHA Mortgages and Bankruptcy/Guidelines

Louisville Kentucky FHA Guidelines

Guide to Louisville Kentucky FHA Mortgages and FHA mortgage underwriting for purchase, streamline & standard refinance.

// //

Learn More

Below, you will find a guide to the “standard” Louisville Kentucky FHA Mortgages FHA loan guidelines used in the underwriting process of an FHA mortgage. (Louisville Kentucky FHA Mortgages(

•Traditional Guidelines:

◦Neither the lack of traditional credit history, nor the lifestyle of the borrower may be used as a basis for rejection.

◦Collections: Based upon the surrounding circumstances, and as determined by our underwriter, these do not necessarily have to be paid.

◦Judgment: Judgments are required to be paid off before the mortgage loan is eligible for insurance. However, exceptions can be made if the borrower has been making regular timely documented payments and the creditor is willing to subordinate the judgment to the insured mortgage.

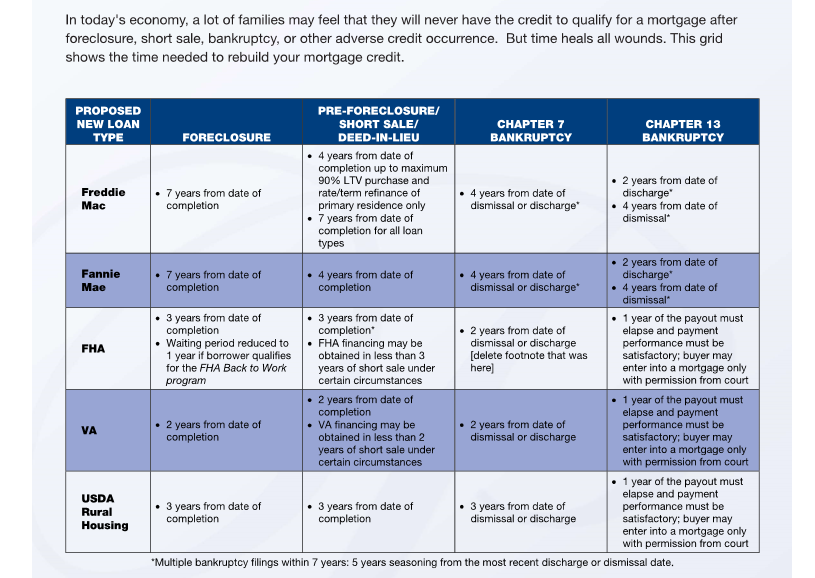

◦Foreclosure: A borrower whose previous residence or other real property was foreclosed on, or who has given a deed-in-lieu of foreclosure within the previous three years is not generally eligible. Exceptions can be made based upon extenuating documented circumstances.

◦Chapter 7 Bankruptcy: Will not disqualify a borrower if at least two years have passed since the bankruptcy was discharged.

◦Chapter 13 Bankruptcy: A borrower paying off debt under Chapter 13 may also qualify if at least one year of the pay out period has elapsed with satisfactory payment performance and the court approves the borrower entering into a mortgage transaction.

•Aliens: FHA will insure mortgages made to lawful permanent resident aliens under the same terms and conditions as a US citizen.

•No Income Restrictions.

•Higher Ratios: HUD‘s standard ratio guidelines are 29% (maximum exception of 36%) of your gross income for housing and 41% (maximum exception of 50%) of your gross income for housing plus other creditors. Borrowers may, at the underwriter’s discretion, be allowed to extend beyond these ratios based upon sufficient compensating factors.

•Down Payment: The minimum down payment is approximately 3.5%. While credit quality can affect this qualifying requirement, the typical borrower only needs the standard HUD guideline of 3.5% to be approved.

•Gifts: 100% gift funds are acceptable. The donor may be a relative of the borrower, the employer or labor union, a governmental agency, a not for profit private organization, or close friend with a clearly defined interest in the borrower. No repayment of any gift may be expected or implied. Sellers are allowed to pay all closing costs on behalf of the borrower, up to 6% of the purchase price.

•Reserves: There are no reserve requirements for one and two-family unit residences. Three months reserves are required for three and four-family unit residences.

•Multifamily: Three and four family unit residences, regardless of occupancy status, must be self-sufficient. The maximum mortgage is limited so that the ratio of the mortgage payment, divided by the monthly net rental income does not exceed 100%. The net rental income is the appraiser’s estimate of fair market rent from all units (including the unit chosen by the borrower for occupancy), less the allowance for vacancies and maintenance (which is 15%). 85% of the rental income that is expected from the non-occupied units is added to the borrower’s income for qualifying purposes. Down payment is calculated the same as single-family units.

•Overtime, Bonus, and Part-time Income: Overtime and/or bonus income received for a period of less than two years is acceptable where the underwriter determines that there are reasonable expectations of its continuance. An earning trend over the period of time of receipt must be established and analyzed. Part-time income means income from jobs taken in addition to the normal regular employment to supplement the borrower’s income. The same rules apply for determining using it as a part of qualifying.

•Extended Absence From Workforce: In some cases, the borrower may have recently returned to the work force after an extended absence. The borrower’s income may be considered effective and stable, provided the borrower has been employed in the current job for 6 months or more and the borrower can document a 2 year work history prior to the absence from the work force.

•Rental Income: Rental income from relatives residing on the premises is acceptable, provided the rental income is shown on the borrower’s tax returns.

•Cash Saved at Home: Borrowers who meet the “cash borrower” profile (no traditional credit, no bank accounts, etc.), who have saved cash at home and are able to adequately demonstrate the ability to do so, are permitted to have this money included, with satisfactory explanation, as an acceptable source of funds to close a mortgage loan.

•Child care expenses are NO LONGER included as debt.

•Non Occupant Co-Borrowers: When there are two or more borrowers, but one or more will not occupy the property as a primary residence, the maximum mortgage is usually limited to 75% loan to value. However, maximum financing is available for borrowers related by blood or for unrelated individuals that can document evidence of family type or long-standing and substantial relationship not arising out of the loan transaction. Qualifying is determined by the underwriter.

•Assumable: All FHA loans are assumable.

•Electronic/Online Payroll: The industry as a whole recognizes that some employers use online payroll for pay stubs and W-2s. These types of documentation are acceptable.

•Rate Adjustments: There are no interest rate adjustment “penalties” for higher loan to values with FHA fixed rate loans. The rate, is the rate, is the rate.

•Secondary Financing: Secondary financing is not allowed with an FHA loan. The only acceptable second mortgage is with an approved HUD gifting agent, such as down payment assistance provided by a gov’t agency in the form of a “silent” second mortgage. Piggie Back seconds/HELOCS are simply not allowed.

•Home Inspection: A home inspection may or may not be required on a property, depending on various factors. Typically, you will find it is not required, but is recommended on any existing residence.

•Pest Inspection: A termite inspection is required for all existing properties.

•Closing Costs: Closing costs charged to the borrower are restricted and may, in fact, be less than conventional closing costs (dependent upon your lender or broker).

Fill out my form!

.webp)

%20(2).png)