I specialize in Kentucky First Time Homebuyers FHA, VA, USDA & Rural Housing, KHC and Fannie Mae mortgage loans. I have helped over 900 Kentucky families buy their first home and refinance their current mortgage for a lower rate; Kentucky First time buyers $0 down still available with down payment assistance with KHC. Free Mortgage applications same day approvals. Web site is not endorsed by the FHA, VA, USDA govt agency. Text/call 502-905-3708 kentuckyloan@gmail.com NMLS 57916 NMLS ID 1364

Pages

- 4 Things Required for a KY Mortgage Loan Approval

- Down Payment Assistance Kentucky 2024 Kentucky Housing Corporation KHC

- Credit Scores Required For A Kentucky Mortgage Loan Approval in 2024

- Kentucky First-time Home Buyer Programs

- Kentucky FHA Mortgage Information

- Kentucky VA Mortgage Loan Information

- USDA Rural Housing Kentucky Loan Information

- Zero Down Kentucky Mortgages

- First-time Home-buyers in Kentucky

- Documents Needed Mortgage Approval in Kentucky

- Free Credit Score Booklet

- Do's & Dont's before closing:

- Closing Costs Kentucky Mortgage

- Lock Kentucky Mortgage Loan Rate

- Home Inspections Kentucky

- Home

- Accessibility Statement

- Legal / Privacy Policy / Accessibility Statements

Kentucky USDA Rural Housing Mortgage Lender: Kentucky Rural Housing USDA Maximum Income by Coun...

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Louisville Kentucky Mortgage Lender for FHA, VA, K...

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Kentucky First Time Home Buyer Programs For Home Mortgage Loans: Kentucky FHA, VA and USDA 2023 Loan Limits

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

2023 Loan Limits for Kentucky VA and Kentucky FHA Loans

New 2023 Loan Limits for Kentucky VA and Kentucky FHA Loans |

Kentucky VA loan limits received a massive increase for 2023. The standard Kentucky VA loan limit in 2023 is $726,200 for most U.S. counties, increasing from $647,200 in 2022. Kentucky VA loan limits also increased for high-cost counties to $1,089,300 for a single-family home.

Kentucky VA loan limits do not represent a cap or max loan amount. Veterans with their full entitlement can get as much as a lender is willing to give them without needing a down payment. However, Veterans with one or more active VA loans or who have defaulted on a previous VA loan will encounter the limits, which will in part determine their zero-down buying power.

For Kentucky FHA loan limits, please click here to consult this page on the Hud.gov website as Loan Limits for FHA loans vary by county in Kentucky each 120 counties. |

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Louisville Kentucky Mortgage Lender for FHA, VA, KHC, USDA and Rural Housing Kentucky Mortgages: Kentucky Fannie Mae Loans versus Kentucky FHA Loans

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Kentucky FHA Loans with Bad Credit in 2023.

How to get approved for a Kentucky FHA Mortgage Loan with Bad Credit in 2023.

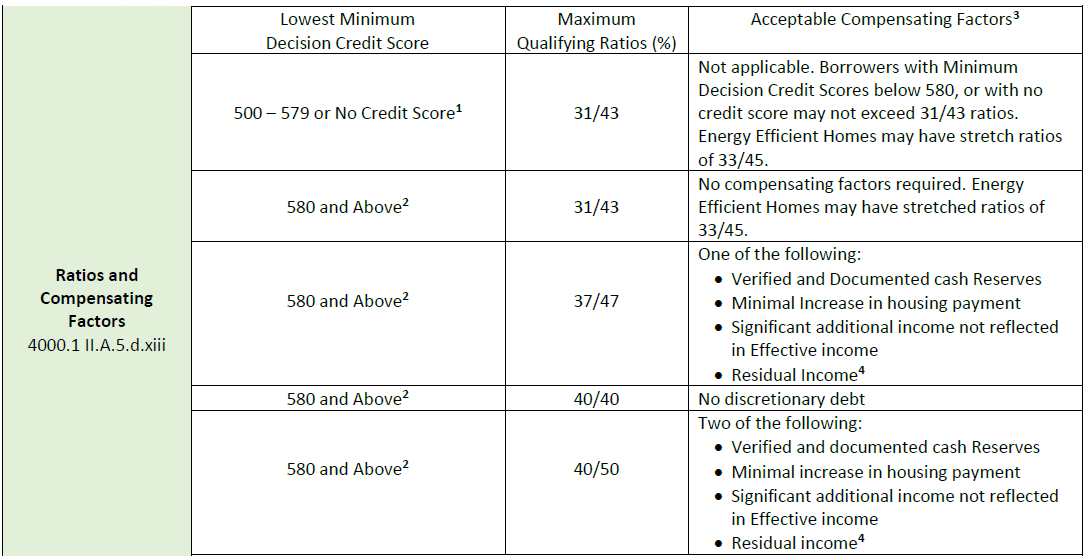

Below details the DTI requirements The maximum Front and Back ratios applicable to manually underwritten Kentucky FHA Mortgages are detailed below.

Maximum DTI allowed for Manual UW is 40/50

**IMPORTANT – any loan where ALL borrowers have No Fico Score, the Maximum DTI is 31/43 per HUD DTI and Compensating Factor Requirements:

560 FICO and Above – DTI up to 31/43.Comp Factors Required - NONE.

560 FICO and Above - DTI up to 37/47Comp Factors Required– 1 Required

560 FICO and Above – DTI up to 40/50Comp Factors Required– 2 Required

ACCEPTABLE COMPENSATING FACTORS:

RESERVES – 3 mo (1-2 Unit) 6 Mo (3-4 Unit)

HOUSING DECREASE – new PITI is no more than $100 or 5%, the lesser of the two

RESIDUAL – Meet VA residual requirements

ADDITIONAL INCOME – Income not reflected in DTI (this comp factor is only permitted when DTI is over 37/47 and if income were used, it would decrease DTI under 37/47)

MANUAL UNDERWRITE REQUIREMENTS ON ALL LOANS

12 Months verified housing history OR rent free letter,

Reserves, AND

1 month reserves for 1-2 Unit

3 month reserves for 3-4 Unit

NOTE: If you use reserves as a compensating factor, then you do not need these reserves in addition

Letter of explanation for all derogatory credit, including any NSFs and/or overdrafts in bank accountIf applicable, 2 months for all bank statements in the file (60 days activity)

Maximum DTI 40/50 (HUD guideline, no exceptions

Instructions for Residual Income as Compensating Factor

Residual income may be used as compensating factor when it meets or exceeds the stated amounts in

the table below. Note that all household members must be counted for ‘family size’ except for individuals

who are fully supported from a verified source of income not included in the effective income of the loan.

Residual Income Calculation When Needed as a Compensating Factor

Gross Monthly Income1 2

- (State income taxes3)

- (Federal income taxes3)

- (Municipal or other taxes3)

- (Retirement deductions and/or Social Security deductions)

- (Total monthly housing payment)

- (Estimated maintenance and utilities4)

- (Job related expenses (e.g., childcare)5)

= Monthly Residual Income for Family Support.

[When using Residual Income as a compensating factor, the “Monthly Residual Income for Family Support” must

meet or exceed the dollar amount in the “Residual Income Table” above.

1 Income from occupying borrowers only

2 Non-taxable income may not be grossed up

3 Federal and state taxes must be used to determine appropriate deductions or paystub if taxes are not available

4 Multiply total living area (sq ft) x 14

5 Childcare letter is not required (as it is for VA) and should not be requested

Exceptions to the Required Residual Income

You may reduce the residual income figure from the above tables by 5% if:

1. The borrower(s) is an active duty or retired serviceperson, OR

2. There is a clear indication that a borrower will receive the benefits resulting from use of military-based

facilities located near the property.

Examples of military service for reduced residual income are:

Guard and Reserve military retirees, 100% disabled Veterans and their family members, or Medal of Honor

recipient.

Joel Lobb

Mortgage Loan Officer

Individual NMLS ID #57916

American Mortgage Solutions, Inc.

10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

NMLS ID# 57916, (www.nmlsconsumeraccess.org).

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Louisville Kentucky VA Home Loan Mortgage Lender: Louisville Kentucky Mortgage Lender VA Home Loans

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

Kentucky Housing Corporation (KHC) Down Payment Assistance.

Kentucky Down payment assistance loans are available up to $10,000 for Mortgage

KHC is used for mostly applicants in Kentucky that don't have access to money for a down payment on their home.

- .

KENTUCKY HOUSING QUALIFYING CRITERIA FOR DOWN PAYMENT ASSISTANCE

$10,000 available thru KHC for down payment assistance KY

What is Kentucky Housing?

Kentucky Housing is a trusted state agency in Frankfort, KY that works with local lenders to ensure all Kentucky home buyers have access to safe and affordable housing with access to down payment assistance help and counseling if needed to buy a home.

Do I need to be a first-time home buyer to do a KHC loan?

No, you do not have to be a first time home buyer with KHC loans.

How much down payment assistance can I get to buy a home in Kentucky?

What is Kentucky Housing?

Kentucky Housing is a trusted state agency in Frankfort, KY that works with local lenders to ensure all Kentucky home buyers have access to safe and affordable housing with access to down payment assistance help and counseling if needed to buy a home.

Do I need to be a first-time home buyer to do a KHC loan?

No, you do not have to be a first time home buyer with KHC loans.

How much down payment assistance can I get to buy a home in Kentucky?

Can I use the $10,000 for repairs to the home or buy stuff for the home?

No you cannot! The down payment assistance can be used for down payment, closing costs and prepaids.

How long can I lock a KHC Loan?

You can lock a KHC Loan for 45 days

How long does it take to close a KHC loan?

It takes about 30 to 45 days typically to close a KHC loan.

Can I just get a down payment assistance loan from Kentucky Housing?

In order to use the down payment assistance programs from KHC, you must do the first mortgage loan with them too. Additional eligibility requirements may apply, including income limits.

What if I have bad credit and I get a KHC loan?

Kentucky Housing loans require a minimum 620 credit score. The usually follow agency guidelines for credit, bankruptcy, foreclosure, collections, etc depending on it is FHA, VA, USDA, Fannie Mae.

Can I build a home with a KHC loan?

Kentucky Housing does not provide temporary construction loans, but we can provide the permanent financing for a new construction property with one of your loan programs including FHA, VA, USDA, or Fannie Mae.

How much can the house cost for a KHC Loan?

Our current purchase price limits are $346,644 in the state of Kentucky Consult your lender to determine the amount you are approved to borrow in regards to agency debt to income ratios requirements. KHC typically will not go above 40% for the front-end housing ratio, or over 50% for the total debt to income ratio. They will make exceptions sometimes.

What is the required down payment for a KHC Loan?

Required down payments range from 0-3.5% depending on the underlying loan product (Conventional, FHA, RD, VA).

Is a co-signer allowed on a KHC Loan?

KHC does not allow for co-signers to qualify for a mortgage loan

Can I finance improvements or repairs?

KHC does not offer rehab loans or 203k loans, or Renovation loans.

Are there income limits based on gross or net income for a KHC?

Gross household income limits for total household income.

Can I finance a manufactured or mobile home with KHC?

Manufactured and mobile homes are eligible under some mortgage products for KHC Loans. Homes must be double-wide, permanently attached to a foundation, and taxed as real estate (not personal property). Consult your lender for more information.

Can I use the $10,000 for repairs to the home or buy stuff for the home?

No you cannot! The down payment assistance can be used for down payment, closing costs and prepaids.

How long can I lock a KHC Loan?

You can lock a KHC Loan for 45 days

How long does it take to close a KHC loan?

It takes about 30 to 45 days typically to close a KHC loan.

Can I just get a down payment assistance loan from Kentucky Housing?

In order to use the down payment assistance programs from KHC, you must do the first mortgage loan with them too. Additional eligibility requirements may apply, including income limits.

What if I have bad credit and I get a KHC loan?

Kentucky Housing loans require a minimum 620 credit score. The usually follow agency guidelines for credit, bankruptcy, foreclosure, collections, etc depending on it is FHA, VA, USDA, Fannie Mae.

Can I build a home with a KHC loan?

Kentucky Housing does not provide temporary construction loans, but we can provide the permanent financing for a new construction property with one of your loan programs including FHA, VA, USDA, or Fannie Mae.

How much can the house cost for a KHC Loan?

Our current purchase price limits are $346,644 in the state of Kentucky Consult your lender to determine the amount you are approved to borrow in regards to agency debt to income ratios requirements. KHC typically will not go above 40% for the front-end housing ratio, or over 50% for the total debt to income ratio. They will make exceptions sometimes.

What is the required down payment for a KHC Loan?

Required down payments range from 0-3.5% depending on the underlying loan product (Conventional, FHA, RD, VA).

Is a co-signer allowed on a KHC Loan?

KHC does not allow for co-signers to qualify for a mortgage loan

Can I finance improvements or repairs?

KHC does not offer rehab loans or 203k loans, or Renovation loans.

Are there income limits based on gross or net income for a KHC?

Gross household income limits for total household income.

Can I finance a manufactured or mobile home with KHC?

Manufactured and mobile homes are eligible under some mortgage products for KHC Loans. Homes must be double-wide, permanently attached to a foundation, and taxed as real estate (not personal property). Consult your lender for more information.

Kentucky Down payment assistance loans are available up to $10,0000 for Mortgage

KHC recognizes that down payments, closing costs, and prepaids are stumbling blocks for many potential home buyers. We offer a special loan program to help with those. Your KHC-approved lender can help you apply.

KHC recognizes that down payments, closing costs, and prepaids are stumbling blocks for many potential home buyers. We offer a special loan program to help with those. Your KHC-approved lender can help you apply.

Regular DAP

- Purchase price up to $349,525 with Secondary Market.

- Assistance in the form of a loan up to $10,000 in $100 increments.

- Repayable over a 10-year term at 3.75 percent.

- Available to all KHC first-mortgage loan recipients.

- Purchase price up to $349,525 with Secondary Market.

- Assistance in the form of a loan up to $10,000 in $100 increments.

- Repayable over a 10-year term at 3.75 percent.

- Available to all KHC first-mortgage loan recipients.

More About Down Payment and Closing Costs

- No liquid asset review and no limit on borrower reserves.

- Specific credit underwriting standards may apply to down payment programs.

- .

- No liquid asset review and no limit on borrower reserves.

- Specific credit underwriting standards may apply to down payment programs.

- .

SECONDARY MARKET FUNDING SOURCE

- Borrower must meet KHC’s Secondary Market Income Limits

- Minimum credit score of 660

- 3 percent down payment

- Monthly mortgage insurance (charter coverage)

- All KHC DAPs applicable

- No minimum borrower contribution

- No reserves required

- 80 percent AMI income

- Minimum credit score of 660

- 3 percent down payment

- Monthly mortgage insurance (standard coverage)

- All KHC DAPs applicable

- No minimum borrower contribution

- No reserves required

- Secondary Market Income limits apply

- Insured by the Federal Housing Administration

- 3.5 percent down payment

- All KHC DAPs applicable

- Upfront and monthly mortgage insurance

- Minimum credit score of 620

Refinance Options (Available only through Secondary Market)

- Credit qualifying Streamline Refinance and Rate/Term Refinance

- Insured by the Federal Housing Administration

- Cash back to borrower not to exceed $500

- Upfront and monthly mortgage insurance

- Minimum credit score of 620

- Guaranteed by the Veterans Administration for qualified military veterans

- No down payment if the property appraises for the sales price or greater

- All KHC DAPs applicable

- Minimum credit score of 620

- No monthly mortgage insurance payments

Refinance Options (Available only through Secondary Market)

- VA IRRRL

- 620 minimum credit score

- No appraisal required

- 30-year term

- VA existing loan

- Guaranteed by Rural Housing Services (RHS)

- Home must be located in a rural area as defined by RHS

- No down payment if the property appraises for the sales price or greater

- All KHC DAPs applicable

- Upfront and monthly mortgage insurance

- Minimum credit score of 620

Refinance Options (Available only through Secondary Market)

- RHS Streamlined-Assist Refinance Program

- 620 minimum credit score

- No appraisal required

- Must have made timely mortgage payments for the last 12 months

- 30-year term

- RHS existing 502 guaranteed loan

KENTUCKY HOUSING CORPORATION

2021 SECONDARY MARKET

GROSS ANNUAL APPLICANT’S INCOME LIMITATIONS

Effective May 1, 2021

Secondary Market Purchase Price Limit — $346,644

- Borrower must meet KHC’s Secondary Market Income Limits

- Minimum credit score of 660

- 3 percent down payment

- Monthly mortgage insurance (charter coverage)

- All KHC DAPs applicable

- No minimum borrower contribution

- No reserves required

- 80 percent AMI income

- Minimum credit score of 660

- 3 percent down payment

- Monthly mortgage insurance (standard coverage)

- All KHC DAPs applicable

- No minimum borrower contribution

- No reserves required

- Secondary Market Income limits apply

- Insured by the Federal Housing Administration

- 3.5 percent down payment

- All KHC DAPs applicable

- Upfront and monthly mortgage insurance

- Minimum credit score of 620

Refinance Options (Available only through Secondary Market)

- Credit qualifying Streamline Refinance and Rate/Term Refinance

- Insured by the Federal Housing Administration

- Cash back to borrower not to exceed $500

- Upfront and monthly mortgage insurance

- Minimum credit score of 620

- Guaranteed by the Veterans Administration for qualified military veterans

- No down payment if the property appraises for the sales price or greater

- All KHC DAPs applicable

- Minimum credit score of 620

- No monthly mortgage insurance payments

Refinance Options (Available only through Secondary Market)

- VA IRRRL

- 620 minimum credit score

- No appraisal required

- 30-year term

- VA existing loan

- Guaranteed by Rural Housing Services (RHS)

- Home must be located in a rural area as defined by RHS

- No down payment if the property appraises for the sales price or greater

- All KHC DAPs applicable

- Upfront and monthly mortgage insurance

- Minimum credit score of 620

Refinance Options (Available only through Secondary Market)

- RHS Streamlined-Assist Refinance Program

- 620 minimum credit score

- No appraisal required

- Must have made timely mortgage payments for the last 12 months

- 30-year term

- RHS existing 502 guaranteed loan

KENTUCKY HOUSING CORPORATION

2021 SECONDARY MARKET

GROSS ANNUAL APPLICANT’S INCOME LIMITATIONS

Effective May 1, 2021

Secondary Market Purchase Price Limit — $346,644

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.

I have helped over 1300 Kentucky families buy or refinance their home over the last 20 years. Realizing that this is one of the biggest, most important financial transactions a family makes during their lifetime, I always feel honored and respected when I am chosen to originate their personal home loan. You can count on me to deliver on what I say, and I will always give you honest, up-front personal attention you deserve during the loan process.

I have several advantages over the large banks in town. First, I can search and negotiate for your loan options through several different mortgage companies across the country to get you the best deal locally. Where most banks will offer offer you their one set of loan products. I have access to over 10 different mortgage companies to broker your loan through to get you the best pricing and loan products that may not fit into the bank's program due to credit, income, or other underwriting issues.

You will not get lost in the shuffle like most borrowers do at the mega banks; you're just not a number at our company, you are a person and we will treat you like one throughout the entire process.